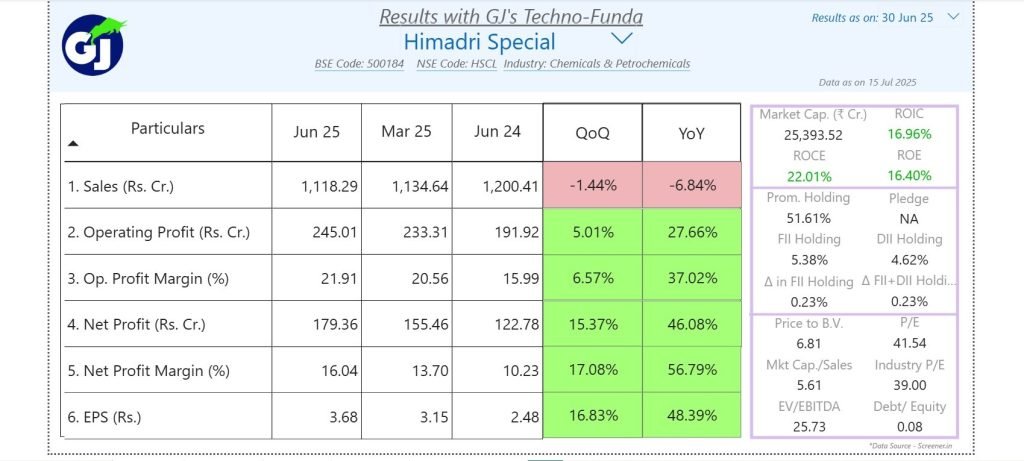

Himadri Speciality Chemical Q1 FY26 Results: profit soared on better margins, even as sales dipped. See key financials and insights. – HSCL Bird’s Eye View

Himadri Speciality Chemical Q1 FY26 Results – Financial results table of HSCL, showing profit soared, improved margins, and key ratios—ideal for analyzing Himadri Speciality Chemical results – Bird’s Eye View

Himadri Speciality Chemical Ltd (HSCL) is a leading Indian manufacturer of specialty chemicals, including coal tar by-products like carbon black, which is a key raw material in tyre manufacturing. Carbon black enhances tyre strength, durability, and resistance to wear, making HSCL a crucial player in the tyre supply chain.

Birla Tyres, previously part of Kesoram Industries, was acquired by a consortium led by Dalmia Bharat Refractories Limited (DBRL) and Himadri Speciality Chemical Ltd in 2023, with HSCL completing the acquisition of a 99.99% stake in Birla Tyres on March 29, 2025, for INR 1 million. Birla Tyres became a wholly-owned subsidiary of HSCL effective April 7, 2025, following the conversion of optionally convertible debentures (OCDs) into equity shares.

Birla Tyres unveiled a new brand identity, logo, and corporate website in June 2025, signaling a strategic repositioning to become a high-performance, future-ready global player in the tyre industry. This rebranding aligns with efforts to ramp up production and focus on high-growth segments like OHT and CV tyres.

Himadri Speciality Chemical Q1 FY26 Results: Profit Zooms – Key highlights –

Sales Volume: Sales Volumes increased by 1% yoy to 1,40,090 MT in Q1 FY26; Revenue was impacted due to the correction in raw material prices.

Margin Expansion: Despite a 6.84% year-on-year drop in sales, operating profit jumped nearly 28% and net profit surged 46%. This shows a significant improvement in margin management.

Efficient Operations: Operating profit margin climbed to 21.91%, up over 6% quarter-on-quarter, and the net profit margin hit 16.04%. For investors, this suggests the company is controlling costs and driving operational efficiency.

Solid Returns: With a Return on Equity (ROE) of 16.40% and ROCE at 22.01%, HSCL displays strong capital efficiency, which often translates to shareholder value over time.

Low Debt, High Potential: A very low debt/equity ratio of 0.08 further strengthens the company’s balance sheet.

Attractive Valuations: The price-to-earnings (P/E) ratio stands at 41.54, and the market cap-to-sales ratio is 5.61, which should be compared with industry peers for investment decisions.

What’s Driving HSCL’s Growth?

Several factors are fueling HSCL’s success. The company’s strategic acquisition of Birla Tyres Ltd, completed in March 2025, is a game-changer. With a ₹306 crore investment, HSCL is ramping up Birla Tyres’ capacity in high-demand segments like Off-Highway Tyres (OHT) and Commercial Vehicle (CV) tyres. This move leverages HSCL’s expertise in carbon black production, a key raw material, to boost quality and market share. Additionally, exports account for 26% of revenue, tapping into lucrative international markets.

Strategic Growth Initiatives

HSCL’s ₹1,771 crore capex plan includes:

| Birla Tyres* | LFP | Speciality Carbon Black | Speciality Chemicals | |

| Strategy | Turnaround + Gain Market Share | Pioneer in India | Forward Integration | Vertical Integration |

| Capex | Rs. 306 Cr | Rs. 1,125 Cr | Rs. 220 Cr | Rs. 120 Cr |

| Operational Commencement | Q1FY26 | Q3FY27 | Q3FY26 | Q2FY27 |

| Expansion | Acquisition | Greenfield | Brownfield | Brownfield |

- ₹1,125 crore for a greenfield LFP – To produce 2,00,000 MTPA of Lithium Iron Phosphate (LFP) Cathode Active Material, catering to 100 GWh of Li-ion Battery, in a phased manner over the next 5-6 years

- Additionally, HSCL is scaling its lithium-ion battery materials business, aiming for a 100 GWh capacity to meet growing demand in electric vehicles and energy storage.

- ₹220 crore for brownfield expansion to increase carbon black production by 130,000 MTPA by Q3 FY26.

- ₹306 crore for Birla Tyres’ revival, targeting OHT and CV segments.

- The company’s R&D center drives innovation in sustainable products, with 25% of Q1 FY26 revenue from value-added products.

Read more about HSCL – Himadri Speciality Chemical on Screener.in

BSE: 500184 NSE: HSCL

This is not a Buy/Hold/Sell recommendation.

Standard Warning: Investments in the securities market are subject to market risks. Please read all related documents carefully before investing.

Disclaimer – Ghansham Joshi Prop of GJ’s Techno Funda – https://caghanshamjoshi.com/disclaimer/

Disclosure As Per Securities And Exchange Board Of India (Research Analysts) Regulations, 2014 – https://caghanshamjoshi.com/disclosure/

#HSCL #ResultsUpdate #StockmarketIndia #Stockmarketlearning

Super se bhi upar analysis..